Medicare

Supplement in the Great Plains!

Medicare pays a large part of health care expenses for the senior

population. It doesn’t pay all the expenses. Medicare recipients

should consider purchasing a private supplemental insurance policy

to offset the cost remaining after the original Medicare pays its

share. But, even some Nebraska Medicare supplemental policies won’t pay for certain kinds of medical expenses.

Read Complete Guide to Michigan Medicare Insurance

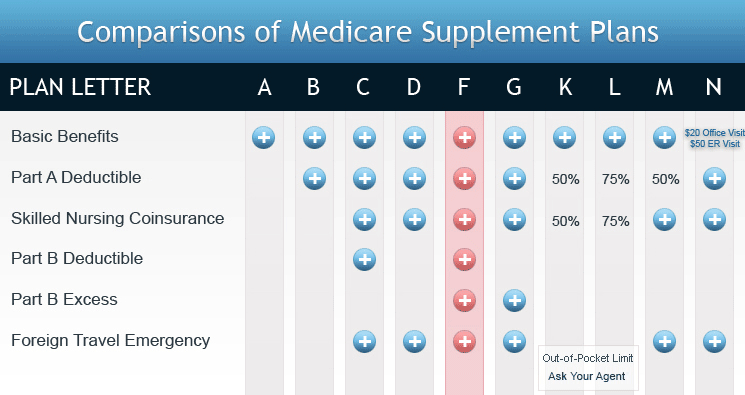

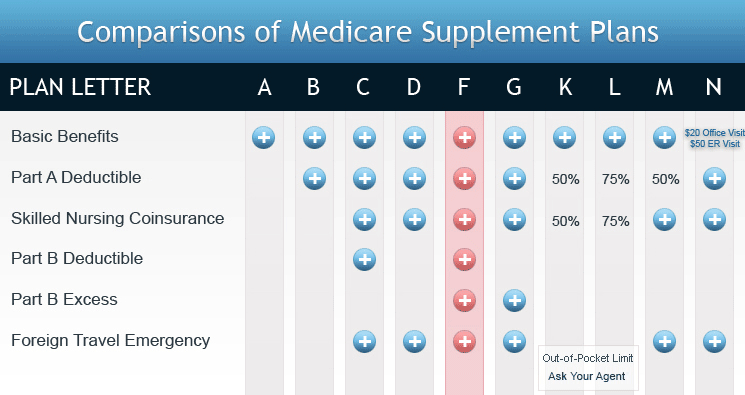

Plan "A" is considered a basic plan. However, it doesn’t

pay the hospital deductible. Plans "B" through "L"

provide additional benefits. Before considering any policy, it’s

important to understand what the Medicare benefits are, and then decide

on the amount of extra coverage needed.

People who can enroll in Medicaid don’t need additional insurance.

Medicaid reimburse almost for every health care costs, including long-term care

in a nursing facility.

Some people may be able to carry over the Medicare health insurance policy

they had before age 65. Anyone having group coverage should talk to

his or her employer about converting it to a supplemental Medicare plan.

You should purchase only one Nebraska Medicare supplement

policy.

Compare these policies with those being sold by other Medicare companies to

see which provides the best coverage. Before purchasing a policy,

it’s wise to consult someone who understands insurance, as well

as your individual financial situation, and who can help you explore

policy options. It's important to remember that slight differences

in wording can greatly change meanings/coverage.

Local Nebraskan insurance agents can often be of help. If the agent

says the policy covers a stay in the local nursing home, go ask the

administrator. It may be that your stay will only be covered if you

receive a higher level of care than is available at the home, so the

policy would be a poor buy.

If an agent says the policy pays everything Medicare doesn’t,

be sure there’s no reasonable and customary limitation. The

amount approved by Medicare is determined solely by Medicare and is

the fee most frequently charged in a geographic area for the specific

services that have been received.

Nebraska supplemental Medicare companies law allows a company to exclude

existing illnesses for only six months. Other types of Medicare policies

may have longer or permanent exclusions, so read them carefully.

• Look for a renewal clause. Check to see if the policy can

be renewed for the lifetime of the policyholder.

• Agents selling Nebraska Medicare Supplemental Insurance must be licensed by the state and carry proof of such licensing. Don't

be misled into thinking that the agent is representing Medicare or

any government agency.

• Complete the application carefully. The insurance company can deny a claim if necessary information is omitted.

• Never pay the agent in cash. Make the check or money order

payable to the insurance company.

These tips on purchasing a Nebraska Medicare Advantage plans are basic

and easy to understand. Please visit the Medicare Supplement Insurance home page for a complete overview of the Nebraska supplement Medicare Insurance

industry.

Related Articles

Medicare Supplement Insurance in Pennsylvania

Information on New York Medicare Supplements is Available

New Jersey Supplemental Insurance at your Fingertips

Ohio Real Time Medicare Insurance Support

ht-182-90-06232012 |