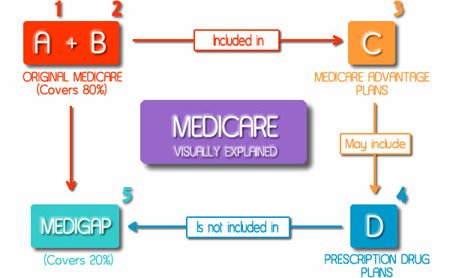

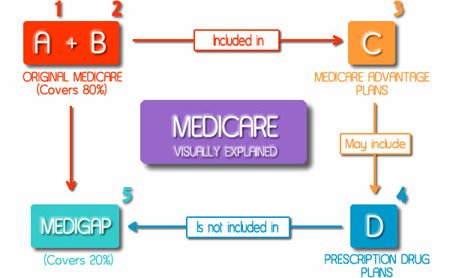

Original Medicare Health Plan Explained:

The Original Medicare is a health insurance plan administered by the government. It is available to the residents of the United States. Under this health insurance plan, you may visit any physician who accepts Medicare or to any hospital that offers you services which are covered under Medicare.

If you do not pick another Medicare health insurance plan, you will automatically be enrolled under Original Medicare plan. The Original Medicare health plan does not cover out-of-pocket expenses. In addition to Part B monthly premium, you have to give out co-payments and deductible in each benefit period.

Also, you will have to pay total costs for dental care, hearing aids, vision check-up etc which are not a part of your Medicare health insurance plan. In case you do not enroll yourself under Medicare Part D plan, you may have to pay the cost of your prescription drugs.

What is Medicare Supplement Insurance?

Supplement Insurance in Medicare is a special kind of health care insurance that assist a person in paying for some of the additional costs that are left out by Original insurance plans that are available under the Medicare health.

It fills in the gaps in your Medicare coverage, but does not pay entirely for all the costs. You have to pay a monthly amount on top of your Part B in order to get Medicare Supplement health care insurance.

Medicare Supplement health care plans are named in the manner - Plan A through plan N with some exceptions.

Apart from the standard Medicare plan from A to L, Medicare SELECT is another form of insurance policy that is more cost effective than supplemental plan in Medicare. There is, however, a restriction on the number of doctors and hospitals one can visit for medical consultation. One has to check with the insurance department in their respective state to find out if the Medicare SELECT is available in their state or not.

Every insurance plan in Medicare has different benefits, and is designed to fill different gaps that are there in Medicare. There are, however, certain basic requirements which must be fulfilled by each Medicare supplement plan.

Regardless of the insurance company through which it is offered every plan having same designation must provide similar basic benefits. For instance, all F plans must provide coverage for excess charges in Part B, this feature should be there no matter which insurance company is selling it. Insurance companies, however, have the liberty to decide the premium.

One must go through the different options available from various insurance companies before he or she decide on an insurance plan. For example, one plan may just cover for coinsurance and deductibles, while the other may also provide coverage for prescription drugs and health care.

Medicare Supplement Insurance policies are provided by private companies that must abide to certain rules set by Medicare. All Medigap plans must provide coverage for hospital coinsurance, an additional year of hospital care, first three pints of blood every year, and 20% co-payment for medical care.

Medicare Supplement health care policy provides various Medicare benefits which are not included in the Original Medicare such as vision check-up or foreign emergency care. Large numbers of people having Original Medicare also buy Medicare Supplement Insurance. You should take under consideration your financial condition and requirements prior to making any decision.

Who can purchase Medicare Supplement Health Plan?

Anyone residing in the United States having Medicare Parts A and B coverage can purchase Medicare Supplement Insurance plan.

Insurance companies cannot reject your Medicare application or limit your insurance coverage. Medicare Supplement companies do not provide Medicare health care plans for people suffering from kidney failure until they attain the age of 65.

Medicare Advantage Plans Explained:

Medicare Advantage Plans are special health care plans provided by private insurance companies under contract to Medicare. They are also addressed as Medicare Part C plans. You can register yourself under Medicare Advantage Plan in case you live in the plan’s service area. People who are a part of Medicare Advantage plan do not require buying Medicare Supplement health care plans.

Most of the Advantage Plans offer more benefits to people as compared to Original Medicare. For instance, Medicare Advantage Plans includes coverage for various services like Dental check-ups and Vision care etc. Even Medicare Part D prescription drug coverage is included in most of the Medicare Advantage Plans.

Medicare Advantage Plans generally charge a monthly fee which is to be paid along premium for Medicare Part B. According to your needs, buying a Medicare Advantage plan could be a beneficial option for you.

Types of Medicare Advantage plans:

There are many kinds of Medicare Advantage Plans. Not all Medicare health insurance plans are available in all areas.

HMO Plans:

If you buy a Medicare HMO health insurance plan, you must always visit physicians, hospitals, and drugstores that are part of your Advantage plan's network. You got to select a primary care doctor for your plan. A referral is required in case you wish to see a medical specialist. Neither Medicare nor your Medicare HMO health insurance plan will provide coverage services outside of your network except in case of emergency situation. Your HMO plan may comprise of extra benefits like vision care, dental care and hearing exams. You need to pay co-insurance amount to obtain services under this plan.

Medical Savings Account (MSA) Plans:

MSA Plans consist of high deductible option that covers all medical and hospital expenses after you meet the deductible. It also includes a tax-exempt MSA account which can be utilized for paying medical expenses before meeting the deductible. Money is deposited into your MSA account each year by Medicare. In case you don’t spend it all, the money can be used for future expenses.

Preferred Provider Plans (PPOs):

Under PPO plan, you may visit physicians, hospitals and drugstores which are in your network or you may see other Medicare-approved providers. You will have to give out extra money in case you wish to see any doctor who is not a part of your network. You don’t require a referral in order to see a specialist, but you need to get approval for certain services.

Private Fee-for-Service Plans:

Under a PFFS plan, you have an option of visiting doctors or hospitals that are in your network or any other provider who can accept your plan’s payment terms. You do not require any referral in case you need to visit a medical specialist,

Special Needs Plans (SNPs):

These plans provide special care to individuals with special Medicare health care needs. For instance, there a special plans for people in long-term care and people suffering from specific diseases. Medicare Part D prescriotion drug coverage is included in your SNP plan.

Who can join a Medicare Advantage plan?

You are eligible for joining Medicare Advantage Plans if:

- You are enrolled under Medicare Parts A and B

- You are living within the service area of the plan.

- You are not suffering from kidney failure.

In order to enroll under Medicare Advantage plan, you can call up our Medical representative and ask for application. You can also register online at web site Best Medicare Supplement Insurance.

When would you be Able to Join, Drop or Switch Your Medicare Health Care Plans?

You can drop, join or switch Medicare health insurance plans during:

Initial Enrollment Period:

The Initial Enrollment Period is generally the seven-month period beginning three months before an individual becomes eligible to enroll under Original Medicare.

During this period, you get an option to become a part of any Medicare health insurance plan in your service area.

Annual Enrollment Period for Medicare Part C and Part D:

The AEP period begins on October 15th and ends on December 7th every year.

During this time one gets to join, switch and drop Advantage Plans or Part D Prescription Drug Plans.

Enrollment for people who are part of Medicaid as well as Medicare:

If you are a member of both Medicare and Medicaid, you can register, switch or drop plans at anytime.

Special Enrollment Period:

These kinds of plans permit people to join, switch or drop any Medicare health care plan when they would generally not be allowed to do so. These plans are for individuals who:

- become a part of Medicare Part B after their initial enrollment period.

- move out of their plan’s service area.

- are in other special conditions and require changing their Medicare health care plans.

5-Star Special Enrollment Period:

Under this enrollment period, Medicare recipients are allowed to switch over to a 5-star rated Medicare Plan at any time they wish to. It must be noted that you would only be able to switch over to a 5-star Advantage plan if it comes within your area. You can use this enrollment period just once a year.

Read Complete Guide to Medicare Insurance

av 1520 240 01172012

ht-232-90-06192012