Are you aware about the eligibility requirement for Medicare Part D plan?

Do you know about the drugs that are excluded from this plan?

Have you heard about what the critics have said about this plan?

Is there any form of penalty in the plan?

If your answer to the above questions is no or want to review your knowledge than read on.

Under Federal program, Medicare beneficiaries are provided prescription drugs at subsidized costs. This program came into effect in the year 2006. In order to get prescription drug from Medicare a person is required to join a plan from an insurance company or any other Medicare approved private company.

Eligibility Criteria

Individual who are eligible for Medicare Part A or already enrolled in Part B is also eligible for Part D prescription drug coverage. You can either receive the benefits through Prescription Drug Plan or Medicare Advantage Plan (which covers both the prescription drugs and medical services).

To participate, Medicare beneficiaries should positively enroll in a Medicare Part D plan. Eligible Individuals who did not enroll in the enrollment period can receive Part D benefits after paying a late enrollment fee. Dual eligible people, those eligible for Medicaid benefits also, will be transferred to Medicare Part D from Medicaid Prescription Drug Coverage. The names of such people are automatically removed from MA plan as they enroll in PDP.

Excluded Drugs

Drugs that are not approved by the FDA, along with the ones prescribed for off label use, drugs whose payment is available under Medicare Part A or B, purchase of drugs not available by prescription in USA are excluded from Part D drug coverage.

Drugs excluded from Medicaid coverage are also excluded from Part D coverage. These may include:

- Drugs for weight loss, anorexia, or weight gain.

- Drugs used in erectile dysfunction.

- Drugs to promote fertility.

- Drugs used to cure cough and cold.

- Benzodiazepines.

- Barbiturates

- Cosmetic purpose drugs e.g. hair growth etc.

- Mineral and vitamin products excluding fluoride preparation and prenatal vitamins

These drugs can be included in drug plans as supplemental benefits, in case if they are able to meet the requirements. Plans covering such drugs should not pass those costs to Medicare, in case they bill Medicare such drugs they are required to repay CMS.

Criticisms

The program design does not allow federal government to negotiate prices with drug companies. The Department of Veterans Affairs pays an average of 58% less than Medicare Part D. For example VA pays $520 for an annual supply of Lipitor whereas Medicare pays $785 for the same.

Beneficiaries are required to pay full cost of prescription as the bill reach $2700 until it reaches $4350. This coverage gap known as “Donut hole” changes as per plan and from one year to another. Due to this coverage gap around 25% of beneficiaries have to pay from their pocket for much of the year.

As per medical researchers, satisfaction surveys do not give exact evaluation of medical care. Majority of respondents are not sick, so they are obviously satisfied as they never get to use medical care. People who are sick form a small part of the whole respondent base.

Late Enrollment Penalty (LEP) and Ways to Avoid LEP

An additional amount added to Medicare Part D premium is called the Late Enrollment Penalty. A person owes a LEP as the initial enrollment period is over. In this period, of around sixty three days the person does not have Part D drug coverage.

An individual should join Medicare plan as and when he or she is first eligible. Even if the person never had any drug coverage earlier they will not be charged for penalty. Avoid going for sixty three days or more in succession without a creditable coverage. Disclose in your plan any drug coverage you had earlier.

The amount of penalty is determined based on the length of time the person went without drug coverage. The number of uncovered months is multiplied with 1% of “national base beneficiary premium”. The amount is added to the monthly premium after adding it to the nearest @0.10. Every year the national base beneficiary premium goes up and so does the penalty amount.

Tips for First Time Drug Coverage Users

A first time user should approach the pharmacy with:

- Blue, white and red Medicare card

- A valid photo ID (such as passport or state driver’s license)

- Membership card of the plan

In case the individual is also enrolled in Medicaid then they should also bring proof of Medicaid enrollment. In case the person feels the need to go to pharmacy before they receive membership card, they can use the following as proof of membership:

- A letter containing your membership information. This letter is received within two weeks as the completed application is received.

- Confirmation number of enrollment including phone number and the plan name.

- A printed temporary card from Medicare.gov

In case the person does not have any of the above listed items just give your pharmacists with Medicare number or the last four digits of your social security number and they will find the rest of the information. In the last if nothing works out pay for the prescription and gets a receipt. Use it to get your money back as you get your Medicare Part D coverage proof.

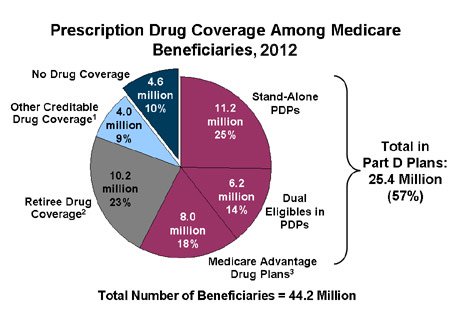

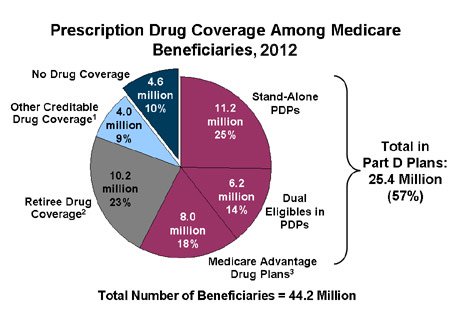

Part D Statistics for 2012

| States |

Medicare Part D Eligible |

Prescription Drug Programs

|

Medicare Advantage Drug Plans (MA-PDs) |

Employer Plans Taking Retiree Drug Subsidies |

Other Prescription Coverage |

Known Credible

Drug Coverage |

| United States |

42,158,217 |

17,32,278 1 |

8,010,244 2 |

6,460,230 |

3,441,207 3 |

34,315,459 |

| Alabama |

698,120 |

339,712 |

116,564 |

426,276 |

138,376 |

491,427 |

| Alaska |

77,527 |

622,914 |

254 |

34,441 |

9,345 |

57,529 |

| Arizona |

853,234 |

231,325 |

290,550 |

403,930 |

139,349 |

428,124 |

| Arkanas |

339,561 |

455,592 |

43,026 |

40,223 |

38,421 |

326,452 |

| California |

4,402,431 |

3,545,786 |

1,420,472 |

327,435 |

431,497 |

2,834,840 |

| Colorado |

564,263 |

665,471 |

161,290 |

35,569 |

33,333 |

284,753 |

| Connecticut |

340,170 |

125,853 |

63,980 |

411,288 |

58,346 |

259,427 |

| Delaware |

137,141 |

54,572 |

2,717 |

33,401 |

36,939 |

417,449 |

| District of Columbia |

73,239 |

87,558 |

5,927 |

5,252 |

24,306 |

29,243 |

| Florida |

3,451,715 |

2,152,557 |

796,646 |

650,681 |

432,231 |

1,312,495 |

| Georgia |

1,323,463 |

254,557 |

102,623 |

654,930 |

666,475 |

549,479 |

| Hawaii |

150,515 |

59,693 |

60,579 |

3,239 |

21,439 |

362,220 |

| Idaho |

248,233 |

85,015 |

31,700 |

23,242 |

32,429 |

472,302 |

| Illinois |

5,742,748 |

753,431 |

110,729 |

436,311 |

375,214 |

4,76,485 |

| Indiana |

357,748 |

524,389 |

49,484 |

594,261 |

135,244 |

694,398 |

| Iowa |

541,548 |

241,116 |

37,513 |

30,148 |

53,240 |

531,347 |

| Kansas |

413,583 |

250,458 |

27,639 |

32,366 |

54,387 |

444,239 |

| Kentucky |

735,037 |

443,395 |

52,482 |

227,460 |

82,469 |

305,946 |

| Louisinana |

642,314 |

377,423 |

109,435 |

37,447 |

32,391 |

541,638 |

| Maine |

248,348 |

323,439 |

6,972 |

23,577 |

44,205 |

399,330 |

| Maryland |

740,525 |

230,146 |

43,944 |

342,401 |

346,740 |

403,211 |

| Massachusetts |

1,343,421 |

322,538 |

168,292 |

385,572 |

203,568 |

348,430 |

| Michigan |

3,341,540 |

535,849 |

252,875 |

341,454 |

212,430 |

2,33,528 |

| Minnesota |

735,512 |

229,312 |

188,510 |

36,156 |

83,351 |

345,415 |

| Mississippi |

451,310 |

233,233 |

18,408 |

39,490 |

31,245 |

402,596 |

| Missouri |

932,410 |

234,534 |

150,867 |

318,445 |

262,245 |

415,341 |

| Montana |

147,265 |

34,453 |

14,013 |

34,205 |

23,488 |

330,339 |

| Nebraska |

268,451 |

251,594 |

20,601 |

34,412 |

39,945 |

236,356 |

| Nevada |

341,668 |

84,341 |

95,315 |

50,347 |

22,537 |

240,340 |

| New Hampshire |

245,348 |

34,379 |

4,279 |

25,645 |

34,752 |

255,395 |

| New Jersey |

4,466,402 |

532,334 |

105,541 |

380,258 |

451,349 |

2,049,548 |

| New Maxico |

487,595 |

135,472 |

60,113 |

33,237 |

34,854 |

344,366 |

| New York |

2,360,351 |

938,133 |

620,818 |

344,471 |

249,742 |

2,103,234 |

| North Carolina |

2,348,139 |

345,316 |

161,955 |

312,436 |

136,344 |

1,126,341 |

| North Dakota |

305,235 |

39,340 |

4,142 |

3,207 |

52,439 |

24,468 |

| Ohio |

3,832,439 |

539,549 |

300,878 |

408,543 |

137,722 |

1,23,122 |

| Oklahoma |

538,348 |

271,304 |

59,212 |

53,453 |

43,456 |

275,125 |

| Oregon |

551,335 |

345,649 |

173,284 |

36,309 |

75,343 |

180,325 |

| Pennsylvania |

4,395,478 |

741,844 |

618,352 |

310,440 |

242,721 |

1,823,667 |

| Rhode Island |

375,377 |

23,341 |

57,165 |

12,332 |

43,317 |

151,225 |

| South Carolina |

402,384 |

439,423 |

64,168 |

318,445 |

338,945 |

621,232 |

| South Dakota |

329,469 |

34,343 |

9,904 |

4,535 |

23,231 |

125,423 |

| Tennessee |

930,539 |

244,523 |

364,542 |

312,738 |

124,293 |

547,457 |

| Texas |

2,734,337 |

2,146,340 |

326,680 |

413,741 |

349,422 |

2,536,423 |

| Utah |

356,511 |

26,422 |

34,242 |

31,245 |

46,142 |

414,600 |

| Vermont |

502,452 |

45,121 |

274 |

38,451 |

63,308 |

87,586 |

| Virginia |

2,455,319 |

463,421 |

28,413 |

319,499 |

262,543 |

843,566 |

| Washington |

581,453 |

239,631 |

214,449 |

417,297 |

153,333 |

405,550 |

| West Virginia |

668,491 |

125,548 |

24,041 |

45,326 |

43,531 |

519,676 |

| Wisconsin |

360,945 |

325,740 |

214,450 |

435,283 |

92,877 |

658,860 |

| Wyoming |

44,659 |

32,040 |

2,274 |

4,756 |

15,600 |

61,796 |

| Residence Unknown |

567,348 |

31,425 |

335,461 |

35,511 |

59,159 |

691,306 |

Read Complete Guide to Medicare Insurance

|