The Medicare Part D policy was started as a voluntary service to outpatients for drug benefits. Effective from January 2006, it was initiated with a view of de-escalating the cost for drugs.

Part D Plans are known as an insurance cover for branded as well as generic drugs for those who end up spending considerable sums of money on medicines. Though these plans have been proposed by law, they are issued by private insurers.

Drug Plans by Medicare cannot be termed as perfect or complete by any means, but still they do help a large number of people in covering their prescription drug bills. Part D Plans compete with each other on the quality of services that they provide, network of pharmacies, premiums, benefits added, therapies if needed and on the number of enrollees.

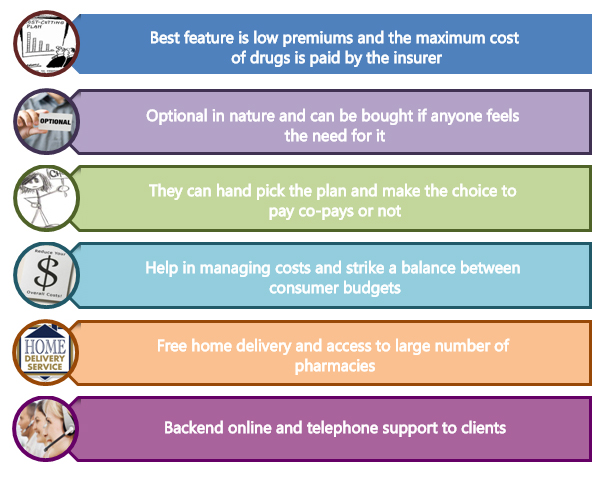

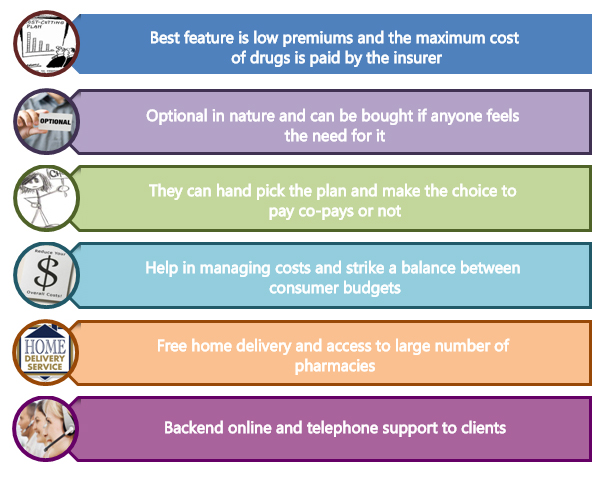

Advantages of Medicare Part D plans:

It is recommended by many that even if you don’t have many medications prescribed it is still a good option to buttress the original Medicare plan with Part D.

Medicare Part D and its function:

Some Medicare Part D plans bear the risk for spending on drugs on behalf of their enrollees. Approximately 75 % of the premium is subsidized by Medicare and further additional funds are granted, if one has low levels of income and assets.

Most Medicare Part D plans would differ from each other on the basis of the services that they are providing, pharmacies that they are working with and their cost. Most of these plans would work on the following guidelines:

- A fee or premium has to be paid on monthly basis and the federals have decided to keep the premium low to $38 for year 2012, which is slightly lower than the premium paid in year 2011

- One needs pay regular premiums, in addition to the premium for Medicare D plan

- If one belongs to higher strata (having a household income from $170,000 and individual income above $85,000) of society, enrollees would need to pay additional fees between $12 - $67, along with the regular premium

- Deductible is the amount that has to be paid yearly before the plan is active (before the plan starts paying for prescriptions). On the basis of the plan that has been chosen, one may or may not need to pay this deductible

- The standard deductible for year 2012, of course varying from plan to plan is $320

- One can share a flat fee with the insurer called a co-pay or may agree to pay a percentage of the cost of drugs usually termed as co-insurance

- Medicare stops paying after a limit of (for the year of 2012) $2,930 and one needs to start paying the costs from one’s own pocket. Albeit, in year 2012 the law has decided to offer 50% discount on branded drugs and generic drug bills would have a discount of 14% on them

- On reaching the higher limits ($4,550) Medicare would start paying again for drugs. Medicare pays almost 95% of the costs incurred after one reaches the catastrophic limit

Enrollees should keep in mind that coverage of Part D plans is not standardized and it keeps varying from company to company and state to state.

Medicare Part D premiums and Prescription Coverage:

Each Part D plan has a blueprint of the list of prescriptions that it covers. These blueprints are termed as FORMULARIES. One can use a formulary finder to know which plan matches the current medications of an individual.

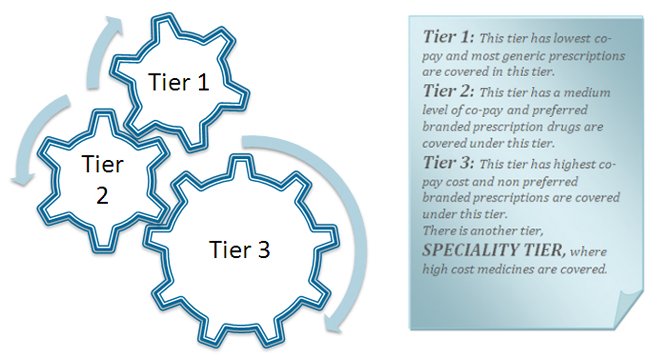

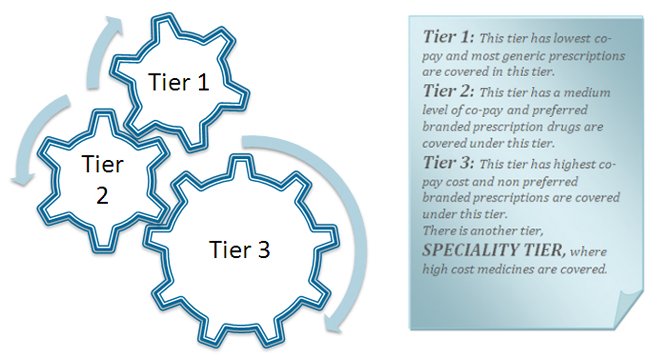

Most of plans are categorized into three tiers. They are summarized below:

If the plan that is selected has a tier system in it, one should be careful about prescription drugs that it covers.

Some of the Part D plans also include step therapy, which means that if a medication is not effective enough, enrollees might be stepped up to the next expensive drug. They might also have a quantity limit on how much drugs can be bought at a particular time.

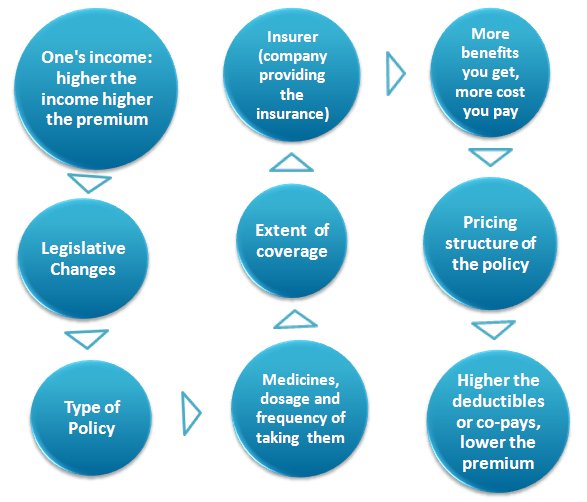

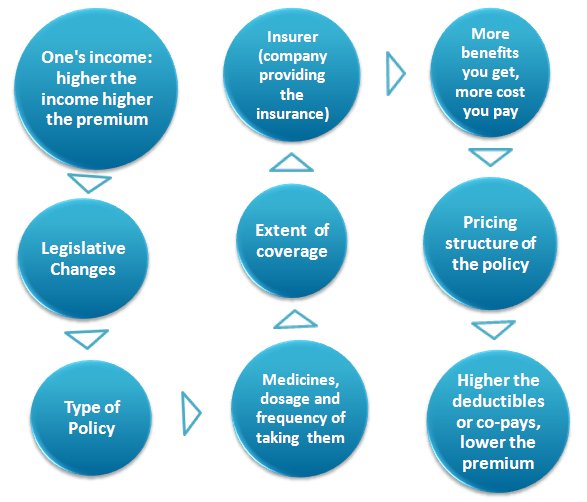

Elements affecting Medicare Part D Premiums:

The above mentioned factors are some of points on the basis of which Medicare Part D premiums are calculated. These points not only help to know what premium is to be paid, also it gives enough time to an individual to evaluate their needs and purchase a suitable plan for themselves.

Part D Plans change every year, as do their premiums, deductibles, co-pays and formularies. New plans replace old plans, so Medicare D customers should review their plans on an annual basis. By modifying the subscribed plan according to individual needs and ensuring that you are enrolled in the right plan, you could potentially save considerable sums over the course of the year and save time.