Medicare & Long Term Care Coverage

It is

simply not true that the government will cover for long term costs through Medicare. However, Medicare covers a limited amount

of skilled care in specific situations. That is it.

To qualify for government

assistance, a person who has been honest and hard working their

whole life would have to give up their accumulated assets to the point of poverty. Welfare,

government assistance, is not what a proud American strives for.

Regardless, the majority of Medicare long term care expenses fall

on the individual to pay.

Medicare Long Term

Care Insurance is a very important insurance. To determine

as to whether this Secondary Supplement Insurance is suitable for you, the following

should be considered:

Current

assets. A long term care policy should not be purchased

in case the person feels that he or she will not be able to afford it at present or in the future.

On the flip side, People who have substantial assets may wish to

save it for their family, a Medicare long term care insurance

policy is an important purchase.

Your

life expectancy. Your family members life expectancy

is a good indication of how long you can expect to live. The longer

the life then the greater risk for needing Medicaid long term care. Term life insurance tables will give you a good indication of life expectancy.

Your

health. Are there health issues that put you at

risk for needing Medicare long term care? Has your family needed

Medicare long term care?

Your gender. Women

live longer. Women are at a greater risk for needing Medicare long

term care. Women, on average, actually spend considerable amount of time in a nursing

home, much more than men due to their long expectancy in life.

Consider

the financial stability of the Medicare Long Term Care Company. Medicare long term care benefits will probably not be used for many

years, you should purchase a Medicare Advantage plan from

a quality insurance company that will be there for you. Rating of a company determined by the industry rating companies is a clear and correct indication of the stability and strength.

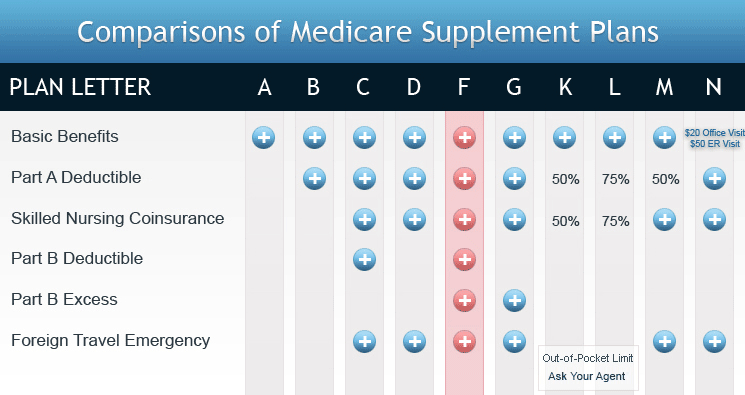

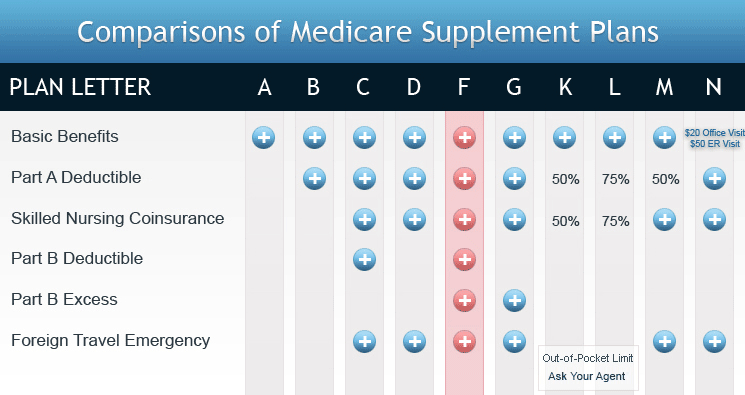

Research,

Research, Research. The Medicare benefits, types of coverage,

premiums of various long term care insurance companies. Nursing

home only policies are available to more comprehensive plans which

cover confinement in several types of facilities. Your Medicare

long term care insurance agent will offer you a proposal for you

that will give you an opportunity to see what the Medicare long

term care insurance industry is offering.

Ask

questions. Ask your insurance agent questions. You deserve clear answers.

Read Medicare Supplement Plans Comparison

ht-285-90-06212012