There are load of options when it comes to buying a Medicare policy for you. Firstly, you need to make up your mind whether you would like to purchase a Medicare Supplemental Policy or a Medicare Advantage Plan.

Medicare Supplemental Plans, also called as Medigap Insurance are health insurance policies which are meant to fill in the gaps in the Original Medicare. Since, your Original Medicare plan pays 80% insurance coverage costs, the remaining 20% is covered by Medicare Supplement Plans. These plans also pay for Parts A and B deductibles.

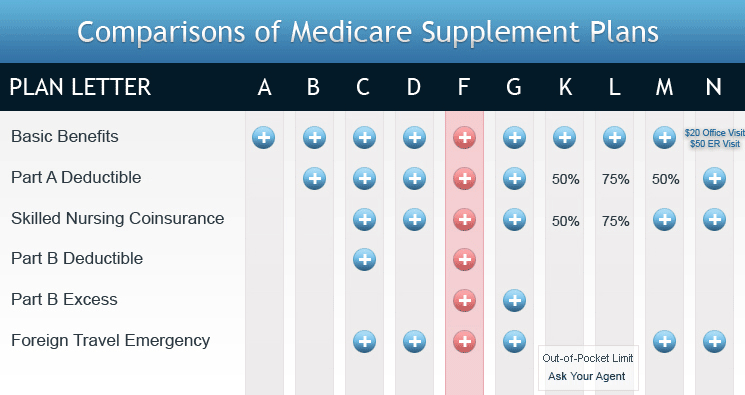

Since Medicare Supplement Plans are standardized, it is important for you to know what each Supplement plan covers so that you can easily compare companies and insurance rates.

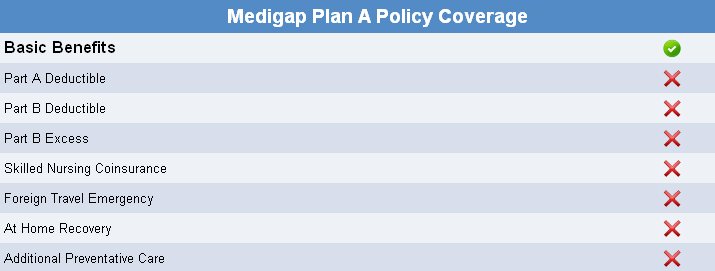

Medicare Supplement Plan A - Basic Coverage at Competitive Prices:

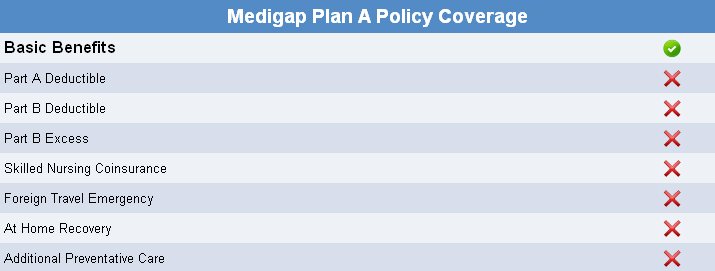

It is compulsory that each insurance company selling Medicare Supplement Insurance or Medigap has to offer Medicare Supplement Plan A to their customers. Plan A provides basic services which are standardized by Medicare. This Plan offers least benefits of any Medicare Supplemental Insurance plan.

Plan A does not fill in the gaps where the Original Medicare stops short. This is reflected in the plan’s price. The monthly premium for this plan is generally quite affordable.

Medicare Supplement Plan A provides basic benefits which are:

- Hospital care: 100% Part A coinsurance along with full coverage for an additional year after the Original Medicare coverage ends.

- Medical Expenses: 100% Part B copayment (generally 20% of the Medicare approved expenses)

- Cost of the first three pints of blood is paid every year.

Medicare Supplement Insurance Plan A also includes hospice care. Nevertheless, Medicare Supplement Plan A fails to provide full coverage for large numbers of Medicare gaps.

For instance, Medigap Plan A does not provide coverage for skilled nursing care, Medicare Parts A and B deductible, overseas travel or Medicare Part B excess charges. The excess charges can be quite crucial since you are responsible for paying the amount which is more than what Medicare approves.

All Medicare Supplement policies are federally standardized. This implies that if you buy Medicare Supplement Plan A, you would be provided with same Medicare Coverage irrespective of from where you purchase it.

Being a basic Medicare Supplement policy, Plan A offers less Medicare coverage as compared to other plans. But, it is ideal for the ones who are on a budget.

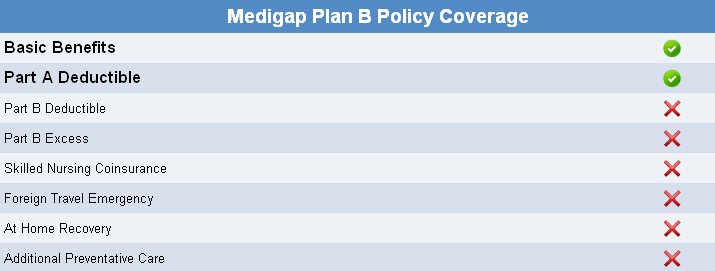

Medicare Supplement Plan B – How it Works?

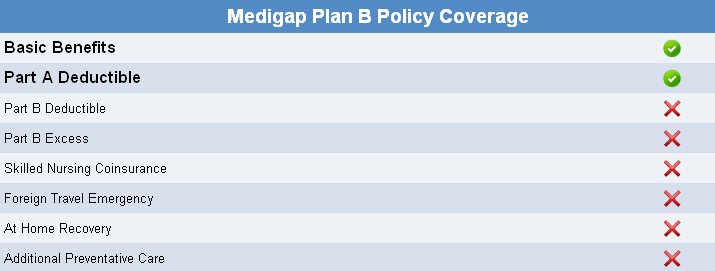

The Medicare Supplement Plan B provides more Medicare coverage as compared to the basic Plan A. This insurance guide will demonstrate what you can expect to receive when you sign up for Medicare Supplement Plan B.

Benefits of Medicare Supplemental Plan B:

- Hospital care: 100% Part A coinsurance along with full coverage for an additional year after the Original Medicare coverage ends.

- Medical Expenses: 100% Part B copayment (generally 20% of the Medicare approved expenses)

- Cost of the first three pints of blood is paid every year.

- 100% Coverage of Medicare Preventive care Part B Co-insurance

- Medicare Part A Hospital Deductible: for each benefit period for hospital services

There are few areas that Medicare Supplemental Plan B does not cover:

Hospice Care Co-payment:

For terminal patients, hospice care could be a good alternative to hospital or home stays. There can be a big fees associated with hospice care. Medicare Supplement Plan B does not pay for co-payments associated with hospice stay.

Medicare Coverage outside the US:

Plan B does not provide insurance coverage for people travelling outside the United States. In case you need medical treatment overseas, you have to pay for the treatment from your pocket entirely.

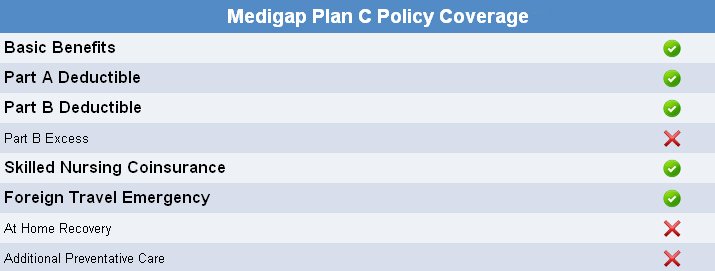

Medicare Supplement Plans C - More than basic healthcare:

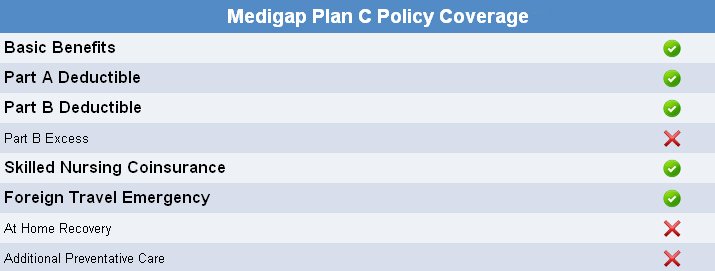

For many people, Medicare Supplement Plan C may be an ideal way to supplement health insurance costs. Below you will find a complete evaluation of what Plan C offers and what it does not cover. Understanding Plan C is important in order to choose a right.

Medicare Supplement Plan C Coverage:

Plan C provides its members basic benefits along with some special benefits. Basic benefits under Medigap Plan C are:

- Hospital care: 100% Part A coinsurance along with full coverage for an additional year after the Original Medicare coverage ends.

- Medical Expenses: 100% Part B copayment (generally 20% of the Medicare approved expenses)

- Cost of the first three pints of blood is paid every year.

- 100% coverage of Medicare preventive care Part B Co-insurance

In addition to these, Plan C provides Medicare coverage for nursing care which is generally paid by Medicare recipients at $133.50 after 20 days up to 100 days is also covered. Medigap Plan C also provides coverage for some expenses associated with foreign travel emergencies.

Medicare Supplement Plan C does not provide Medicare Coverage for:

Costs related to recovery:

After the patient leaves the hospital, they still may need medical attention. Physicians advise their patients to follow some instructions strictly so as to get back to normal condition. Often these instructions bear some additional costs and these costs are not covered by Medicare.

Medicare Part B excess charges:

Part B excess charges are not covered under your Plan C. If your physician does not accept assignment and bills you extra money that is more than what Medicare will pay for you, then it is called an excess charge. You will have to pay for it all by yourself as Medigap Plan C won’t pay for you.

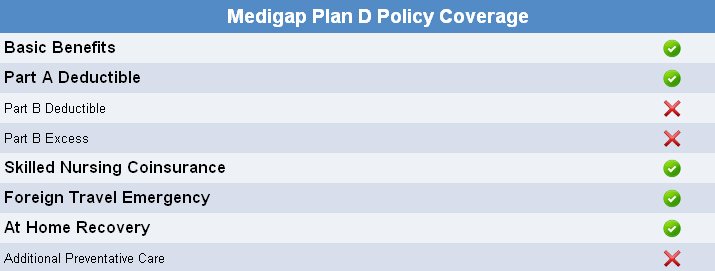

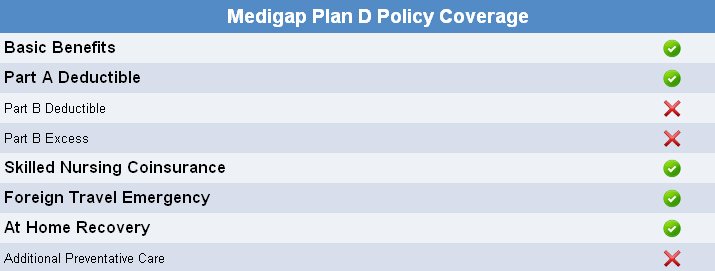

Medicare Supplement Plan D – Costs and Benefits:

Medicare Insurance Supplement Plan D has always proven to be an economical option in select markets. It is made to provide coverage of the high-risk gaps that are not filled by Original Medicare. This Supplemental policy provides lower insurance premiums to the people.

Medicare Supplement Plan D offers basic benefits like:

- Hospital care: 100% Part A coinsurance along with full coverage for an additional year after the Original Medicare coverage ends.

- Medical Expenses: 100% Part B copayment (generally 20% of the Medicare approved expenses)

- Cost of the first three pints of blood is paid every year.

- 100% of Medicare Preventive care Part B Co-insurance

Medicare Supplement Plan D offers basic benefits in addition to some extra coverage. Like Plan C, this plan offers skilled nursing care co-insurance after the initial 20 days. It also pays for the expenses related to recovery at home up till the limits of your Medicare policy are up. Plan D provides coverage for Part A deductible payments. Medigap Plan D also provides coverage for some expenses associated with foreign travel emergencies.

Medicare Supplement Plan D does not provide insurance coverage for:

- Part B deductible payments as it does in case of Medicare Part A.

- Part B excess charges.

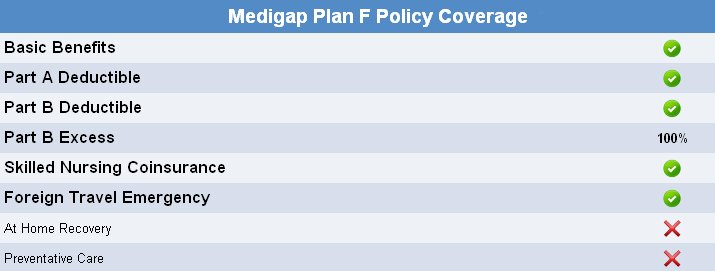

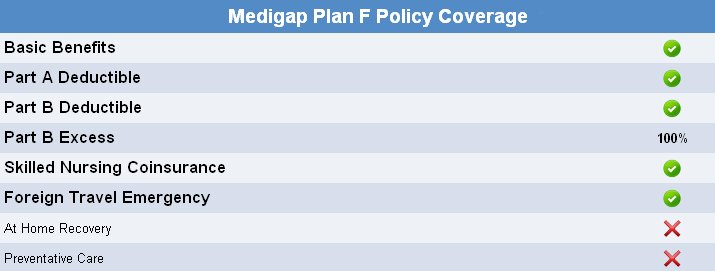

Go with a Medigap Plan F:

Medicare Supplement Plan F is one of the Medigap policies that fill in the gap between the individual requirement of the patient and the actual coverage that Original Medicare provides.

Plan F is certainly the most sought-after Medicare Supplement Insurance Policy now-a-days. Out of all the Supplemental policies, Plans F and G provide coverage for Part B excess charges. Many patients who are a part of Plan F don’t have to pay out-of-pocket expenses related to physician care and hospital visits.

Basic Policy F Coverage:

- Hospital care: 100% Part A coinsurance along with full coverage for an additional year after the Original Medicare coverage ends.

- Medical Expenses: 100% Part B copayment (generally 20% of the Medicare approved expenses)

- Cost of the first three pints of blood is paid every year.

- 100% coverage of Medicare preventive care Part B co-insurance

Other Medicare Plan F Coverage:

- Skilled nursing care

- Medicare emergency help during foreign travels

Medicare Supplement Plan F High Deductible Option:

Medigap Plan F also provides its people an option of high deductible plan. In case a patient decides to go with this option, he or she will have to pay $2000 prior to beginning his insurance coverage. This option can lower down the premium up to a great level.

One area that is not covered by Medicare Supplement Plan F is Hospice care co-payment. This can often lead to financial strain for people who have to face hospice care.

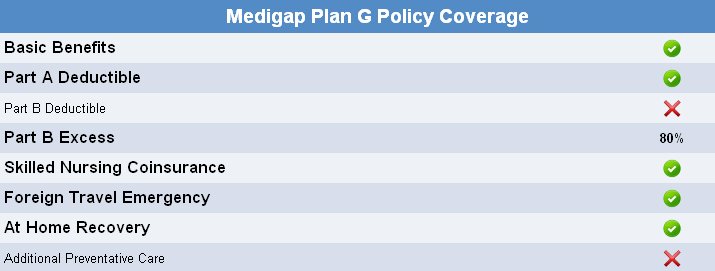

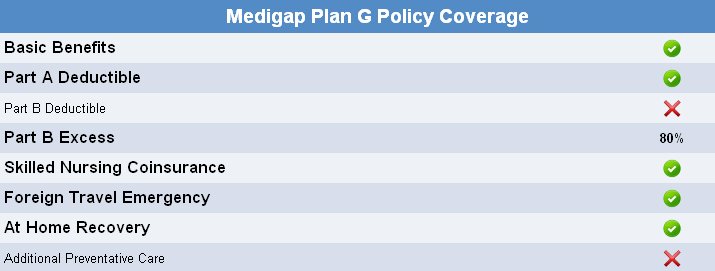

Benefits of Medicare Supplement Plan G:

Medicare Supplement Plan G is similar to Plan F with the only difference that Plan F provides coverage for Medicare Part B deductible, whereas Medicare Supplement Policy G requires Medicare recipients to pay this deductible.

Due to this difference, Plan G has much lower premiums as compared to Plan F. Medicare Supplement Plan G provides full coverage for Part B excess charges.

The basic coverage offered by Plan G comprise of:

- Hospital care: 100% Part A coinsurance along with full coverage for an additional year after the Original Medicare coverage ends.

- Medical Expenses: 100% Part B copayment (generally 20% of the Medicare approved expenses)

- Cost of the first three pints of blood is paid every year

- 100% co-insurance for outpatient services

Additional benefits of Medicare Supplemental Plan G:

- Medicare Part A deductible for hospitalization

- Coverage of 80% Medicare Part B excess charges

- Medicare emergency help during foreign travels

- Skilled nursing care facility

- Recovery-at-home costs are completely or partially covered

Medicare Supplement Policy G does not provide coverage for:

- Medicare Part B deductible

- Hospice care co-insurance

- Preventive care

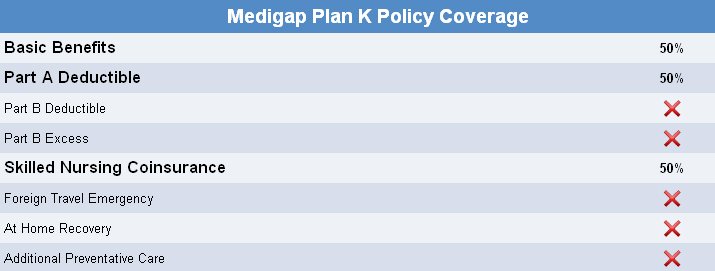

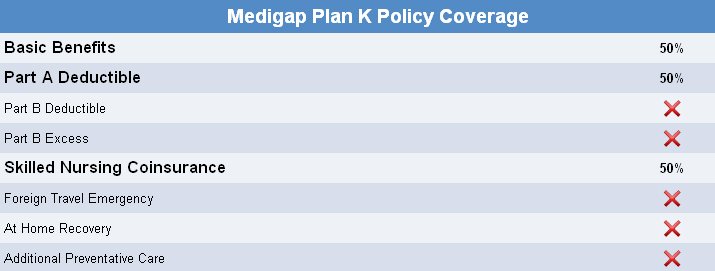

Medicare Supplement Plan K – Moderate Level of Coverage with Low Premium Costs:

Medicare Supplemental Plan K is a bit different plan as compared to other Medigap plans. Instead of giving you maximum benefits, it aims to reduce your yearly deductible. After you meet your annual limit of out-of-pocket expenses and Part B deductible, this plan will provide full coverage of services for the rest of the year.

Medigap Plan K is designed for people who require additional hospice, hospital and skilled nursing care. In addition of providing the benefits of Medicare Part A, it also offers 50% co-payment for a bunch of other services like:

- First three pints of blood every year

- Skilled nursing care co-payment

- Hospice care co-payment

- Medicare Part A deductible (Hospital)

Medicare Supplemental Plan K does not provide coverage for:

- Recovery at home

- Preventive care

- Foreign travel emergency

- Part B excess charges

- Medicare Part B Deductible

The most luring part of this Medicare Supplement Insurance policy is that you will never have to pay a cost above $4600 on medical expenses in one year. All the costs over this are paid completely, and no questions are asked to you when you purchase this Supplemental policy.

The yearly amount that you will have to shell out for Plan K is quite low in comparison to other Medigap policies. Now it is up to you to decide if you wish to pay high premiums or you would pay up till $4600 to the hospitals and select which amount is less.

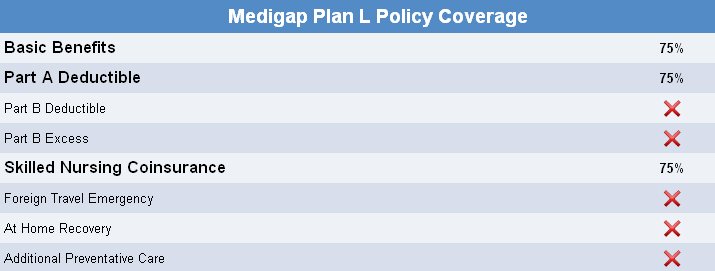

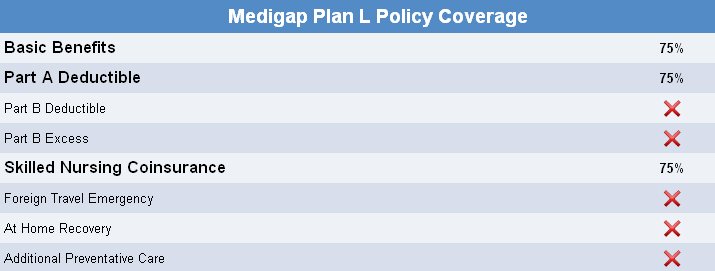

What does Medicare Supplement Plan L Cover?

Plan L is one of the Medicare Supplement Insurance policies which the insurance providers offer to people as per the Federal Medicare law. It pays 100% co-payment for Medicare Part A and also for any hospital expenses after the limits of Medicare Part A end. Nevertheless, there are some limits to the insurance coverage until $2210 deductible is met.

Until the full deductible has been met, Medicare Supplement Plan L will only provide 75% coverage of the co-payment for any non-preventive medical care. It also offers 75% deductible for Medicare Part A, 75% of the cost of blood, skilled nursing care and hospice care until the deductible has been met.

As soon as the Medicare recipient pays for Plan L deductible and annual Part B deductible, his or her Medicare coverage increases up to 100% for all the services.

Plan L does not provide coverage for Medicare Part B excess charges and neither does it help in foreign travel emergency situation. There is no provision of recovery-at-home.

This plan is suitable for people who are in good health and have no financial constraints.

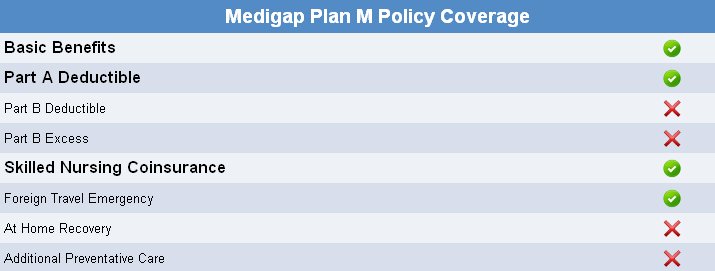

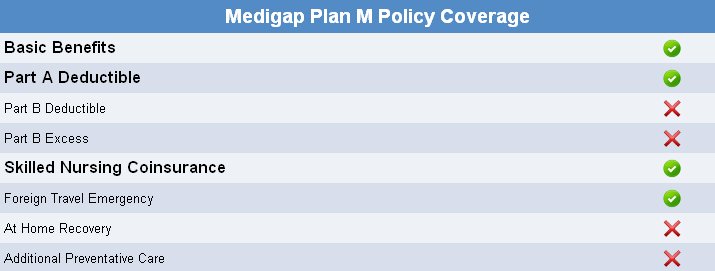

Why do you Need Medicare Supplement Plan M?

Medicare Plan M was introduced on June 1, 2010 along with Medigap Plan N as a part of MIPPA. Like other plans, Medicare Supplement Plan M provides basic benefits like:

- Hospital care: 100% Part A coinsurance along with full coverage for an additional year after the Original Medicare coverage ends.

- Medical Expenses: 100% Part B copayment (generally 20% of the Medicare approved expenses)

- Cost of the first three pints of blood is paid every year.

-

100% coverage for Medicare preventive care Part B co-insurance

Other benefits provided by Plan M are:

- 50% coverage of Part A hospital deductible ($550)

- Skilled nursing care co-payment

- Foreign Travel Emergency insurance coverage

Limitations for Medicare Supplemental Plan M:

- It fails to provide coverage for Part B deductible. ($155)

- It does not provide Medicare coverage for Part B excess charges.

Medicare Supplement Insurance Plan M is ideal for people who wish to keep their hospital costs minimum and feel that they need skilled nursing care.

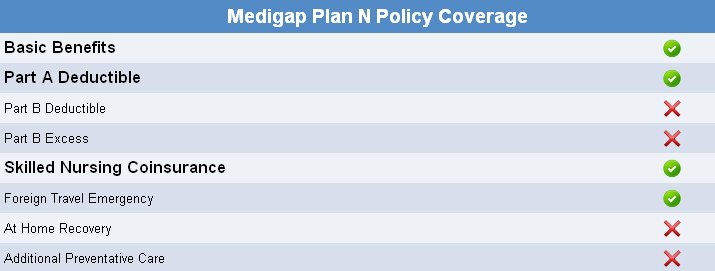

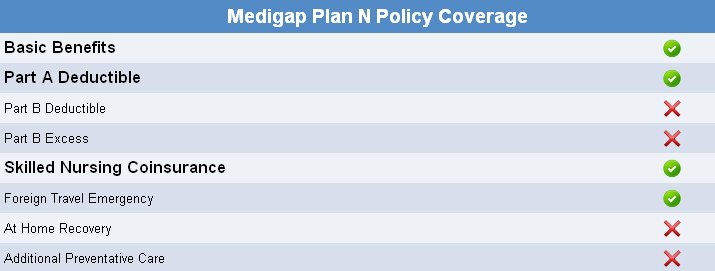

Medicare Supplement Plan N Explained:

Medicare Supplement Plan N was introduced as a part of MIPPA. This plan provides basic coverage in addition to some special benefits. The basic coverage comprises of:

- Hospital care: 100% Part A coinsurance along with full coverage for an additional year after the Original Medicare coverage ends.

- Medical Expenses: 100% Part B copayment (generally 20% of the Medicare approved expenses)

- Cost of the first three pints of blood is paid every year.

-

100% coverage for Medicare preventive care Part B co-insurance

Extra benefits provided by Medicare Supplement Plan N:

- Coverage of Medicare Part B co-insurance. The only Part B co-payments which are not covered are doctor’s office visits and emergency room trips.

- Coverage of Medicare Part A hospice care co-insurance

- Skilled nursing care

- Foreign Travel Emergency Coverage

Medicare Supplement Plan N can cut down out-of-pocket expenses for people who already make co-payments for emergency-room visits.